We assist individuals in preparing and filing their tax returns accurately and promptly. Our experts stay current with the latest tax laws, deductions, and credits to help optimize your tax position and ensure compliance with federal, state, and local tax regulations.

We provide comprehensive tax compliance services for businesses of all types and sizes. Whether you're a sole proprietorship, partnership, corporation, or LLC, we help you navigate the complexities of tax laws and ensure accurate and timely filing of your business tax returns. We assist with federal, state, and local tax compliance, including income tax, payroll tax, sales tax, and other applicable tax obligations.

Our tax compliance services go beyond preparing and filing tax returns. We work with our clients to develop proactive tax planning strategies, taking into account their unique financial circumstances and goals. By projecting your tax liability and optimizing deductions and credits, we help you minimize your tax burden and maximize available tax benefits.

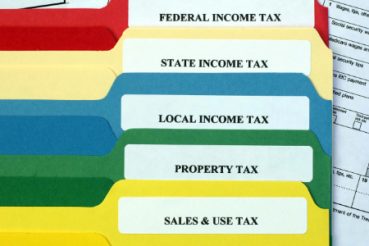

Besides federal tax compliance, we assist businesses and individuals with their state and local tax compliance obligations. This service includes income tax, sales and use tax, property tax, and other tax obligations specific to your jurisdiction. Our professionals stay informed about state and local tax laws to help you navigate the complexities of multi-jurisdictional tax compliance.

If you receive any tax notices, inquiries, or correspondence from tax authorities, our team is here to help. We can assist in reviewing and responding to these notices, ensuring proper compliance, and addressing any issues raised by the tax authorities. We aim to help you navigate tax-related challenges confidently and minimize potential penalties or liabilities.

Teuscher Walpole CPAs can perform compliance reviews and assessments to evaluate your tax compliance procedures and identify potential risk areas. We recommend strengthening your tax compliance processes, mitigating risks, and ensuring accurate reporting.

We are a trusted and experienced team of certified public accountants dedicated to providing our clients with exceptional financial and advisory services.